- GLD and SLV prices are at their lowest since May. Now may be a good time to consider diversifying your ETF portfolio to include precious metals.

- Gold and silver can be volatile in the short and mid-term, but over long periods of time, they are a protection against inflation and geopolitical risk.

- Diversifying 5% of your ETF portfolio in gold and silver gives exposure with reduced costs and increased liquidity.

Along with the election of Donald Trump as the 45th President of the United states came uncertainty in the immediate future of inflationary assets. As the markets begin to react for the longer term, U.S. bond yields were set to a 15-year high on Friday. Markets seem to be increasingly expecting a December increase of Fed interest rates and investors are beginning to price them in. We're also seeing interest rate expectations help boost financial sector stocks. The dollar is strengthening and, simultaneously, indexes are setting record highs. Markets are mostly reacting positively, but what if the experts are wrong? There are still a lot of uncertainties swimming around President-elect Trump's policy proposals. Along with those uncertainties come further blurring of winners and losers of Trump administration policies. Prior to the election, markets were reacting highly negatively to the prospects of a Trump presidency. After his surprise upset, markets reacted the opposite way to the same news. The fact of the matter is nobody knows for certain the impact Trump's policies will have on the nation's publicly-traded companies. The picture appears to be getting somewhat clearer as appointments become more public; however, financial markets, the media, and academia all failed to predict Trump's surprise victory to begin with, so, now is the perfect time to hedge bets in your ETF portfolio with a historically well-known store of value and protector of wealth - gold.

Why an ETF Portfolio?

Advertisement

With the growth of ETFs over the last half decade, constructing a highly-diverse investment portfolio with only a handful of low-cost exchange-traded securities has not only become a possibility, but also a growing reality. I've previously discussed a group of 6 ETFs that provide you a low cost well-diversified portfolio, which provides exposure to U.S. & emerging market equities, real estate, and bonds. Protecting your market-based assets through diversification can help you avoid the shortfalls of picking winners and losers and greatly reduce the risks of your holdings.

Gold and Silver's Place in An ETF Portfolio

Strong equities markets tend not to be very good for gold, but gold has historically been seen as a hedge against uncertainty. If you look back at 2013-2015, there wasn't much volatility in the marketplace. In January & February of 2016, volatility increased, and gold prices rose, as it once again was seen as safe haven. Silver has been seen as gold's little brother. It moves similarly to gold, generally speaking; however, its price can be more affected by demand for industrial use than gold. It has a precious metal aspect to it along with some of the features of other metals. Currency devaluation in countries likeChina and India are likely to boost demand for gold and silver globally. Geopolitical tensions drive up demand, and President Trump is suggesting he will shake things up in Washington. There are plenty of other reasons you'd want to allocate part of your assets into precious metals. Gold and silver have been a great store of value - perhaps, the most historically prominent store of wealth in world history.

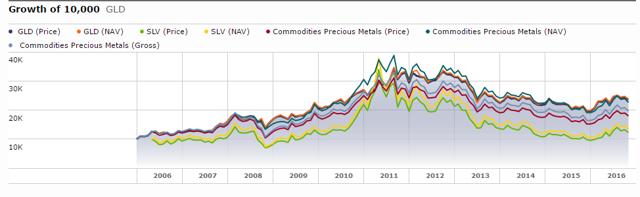

(click to enlarge)

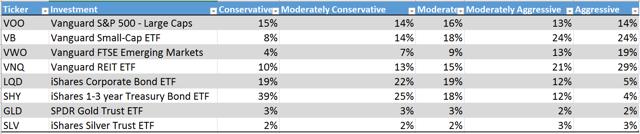

Gold has a historically low to negative correlation with most broad asset classes. Allocating just 5% of our assets into two precious metal ETFs gives us exposure to the historical upside associated with gold and silver during times of geopolitical uncertainty by reducing our bond and real estate exposure. If your portfolio is more aggressive, you can consider allocating a bit more into silver, which has the added upside potential of an increase in global manufacturing of electronic devices. Below is a chart on how we can expand our six-ETF portfolio to add gold to our portfolios.

(click to enlarge)

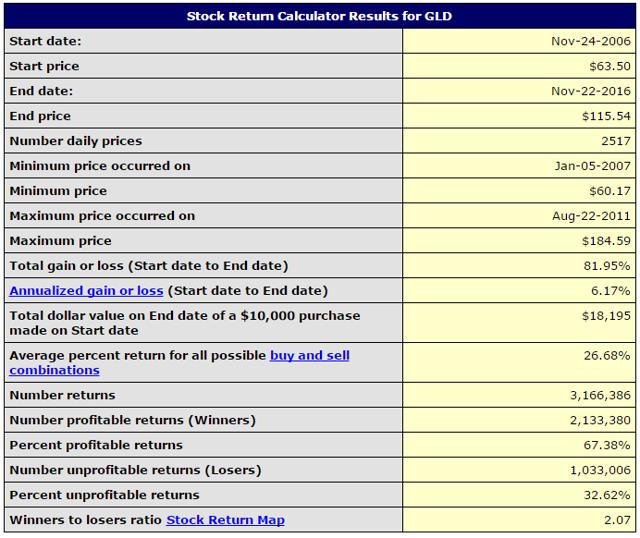

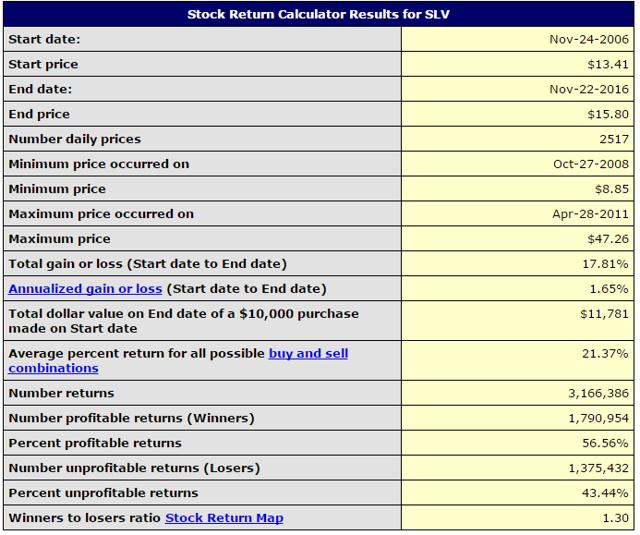

The SPDR Gold Trust ETF (NYSEARCA:GLD) offers a low expense ratio of 0.4% and an average volume of well over 10 million shares traded per day. For the last 10 years, GLD has returned an annualized average of 6.17%, totaling 81.95%. GLD set its 10-year high in 2011 at $184.59, a long way off its current trading price of $113.67. Gold can rally and retreat based upon current events, but returns are more stable in the long term. As far as investing in physical gold trusts, GLD is one of the most popular gold trusts. Year to date, gold has rallied after posting negative returns for the prior 3 years. GLD is trading at its lowest price since January, so now is as good of a time as ever to start diversifying an ETF portfolio into gold assets.

(click to enlarge)

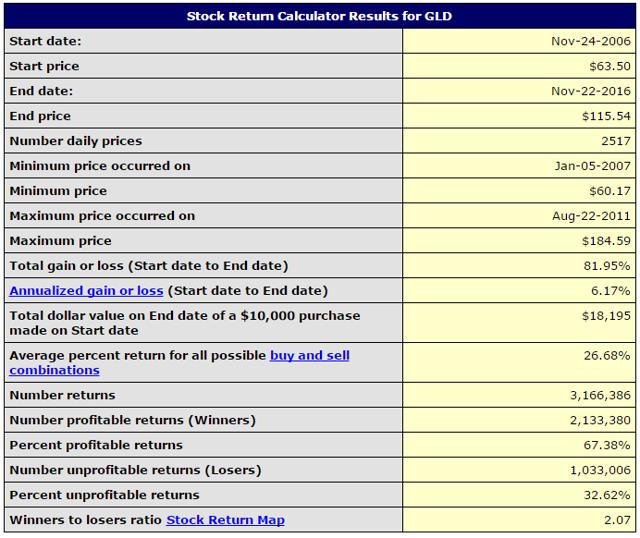

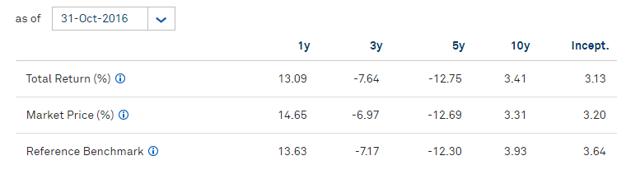

The iShares Silver Trust ETF (NYSEARCA:SLV) gives you exposure to silver with a slightly higher expense ratio of .05%. Silver is more volatile than gold, but its historical value as a money and store of wealth, coupled with its industrial uses, provide two separate avenues for growth as well as volatility. The ETF portfolio above allocates between 2-3% of holdings in silver. Over the last 10 years, SLV has demonstrated more volatility than gold. One great long-term opportunity for silver lies in its industrial use. Almost all electronics contain some silver. Its excellent electrical conductivity makes it the natural choice of electronics manufacturers for use in things like circuit boards, switches, televisions, smartphones and tablets. Over the last decade, silver has been on a wild ride which is why you should only expose a small portion of your portfolio in silver assets. Over the last ten years, silver has returned an average of 3.41% annually. It's historically been known as a store of value, and there are definitely upside opportunities for silver in the future. The volatility in the short and mid-term can put a dent in your portfolio, however. Therefore, silver is really a long-term play for those patient enough to live through the volatility and sell when markets permit profit taking. SLV is at its lowest levels since May. Putting aside 2-3% of your portfolio into silver with a 10-year long-term projection adds exposure to silver along with your new gold position. You may even be able to take profits during rallies.

10-Year Annualized Return on SLV

SLV Returns

The Bottom Line

Gold and silver have historically been seen as money and a store of value. Relative to U.S. currency, gold and silver see increases in prices during times of instability in financial markets and fiat currencies. As a result, the risks associated with potential for political uncertainty stemming from a new U.S. Executive Administration can be hedged by adding two small positions of GLD and SLV to our portfolio. Over a lifetime, fewer assets have the tangible store of value and wealth protection. By adding 5% to our portfolio of ETFs, we are limiting our downside risks, while still taking advantage of long-term opportunities in gold and silver. Of course, you could buy physical gold and silver, but buying GLD and SLV is easier to initiate a position in as well as manage going forward. Silver can be bulky and gold can be difficult to sell locally. Storage and protection costs must be accounted for as well. GLD and SLV do a great job of tracking gold and silver and have a place in any long-term driven portfolio of well-diversified assets.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.